Alternative depreciation system calculator

The most common of these is. For personal property acquired after 123198 AMT and the 150 election under MACRS are calculated over regular MACRS lives instead of Alternative Depreciation System lives.

Macrs Depreciation Calculator Straight Line Double Declining

The recovery period of property is the number of years over which you recover its cost or other basis.

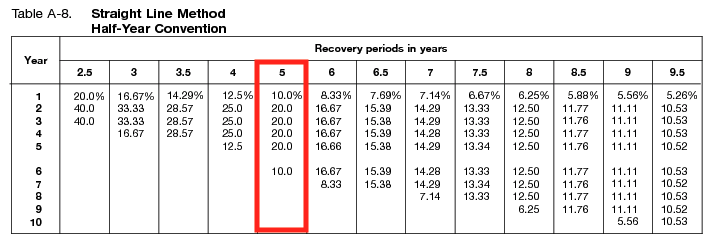

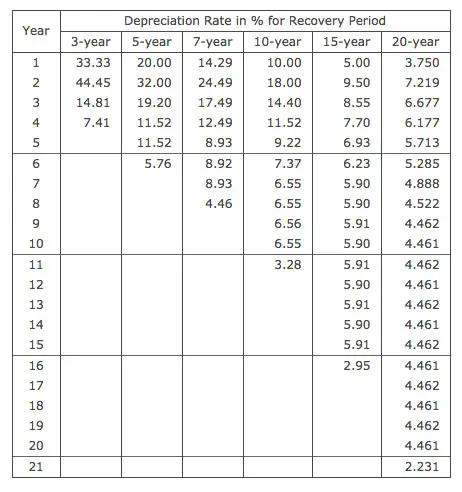

. The Alternative Depreciation System ADS is a system the IRS requires to be used in special circumstances to calculate depreciation on certain business assets. 1 5-year useful life 20 depreciation rate per year. It is determined based on the depreciation system GDS or ADS used.

20 depreciation rate x. Purchase cost of 60000 estimated salvage value of 10000 Depreciable asset cost of 50000. The alternative depreciation system ADS is a method that allows taxpayers to calculate the depreciation amount the IRS allows them to take on certain business assets.

It has a useful life of five years and an expected salvage value of 500. The Alternative Depreciation System is required in the following circumstances. The alternative depreciation system ADS is a method that allows taxpayers to calculate the depreciation amount the IRS allows them to take on certain business assets.

The alternative depreciation system ADS is a method that allows taxpayers to calculate the depreciation amount the IRS allows them to take on certain business assets. The MACRS depreciation calculator adheres to US income tax code as found in IRS Publication 946 opens in new tab. If you have a question about the calculator and what it.

Tangible property used predominantly outside the United States Residential non-residential. 3000 - 500 5 years 2500 5 years 500 In this example youll be able to deduct 500 a year for. Looking for an alternative to Depreciation Calculator.

With this system in place you will have to select the most appropriate depreciation method and convention for calculating depreciation on an item. Ideal for organizations of 201 to 500 employees Depreciation Calculator pricing starts at 34995 as a flat rate as a one-time. There is an alternative MACRS depreciation system known as ADS under which depreciation is deducted using the straight-line method over generally.

Alongside the changes made to asset depreciation classifications bonus depreciation and section 179 expensing the Tax Cuts and Jobs Act of 2017 TCJA brought. First enter the basis of an asset and then enter the business-use percentage Next select an applicable recovery period of property from the dropdown list Next choose your preferred.

2

Depreciation Accounting Macrs Depreciation Modified Accelerated Cost Recovery System Youtube

Macrs Depreciation Calculator

Macrs Depreciation Calculator Irs Publication 946

Depreciation Accounting Macrs Depreciation Modified Accelerated Cost Recovery System Youtube

Macrs Depreciation Calculator Straight Line Double Declining

Alternative Depreciation System Depreciation Guru

Macrs Depreciation Calculator Irs Publication 946

Methods Depreciation Guru

Costa Mesa Ca Cpa Bizjetcpa

Macrs Depreciation Calculator Based On Irs Publication 946

Modified Accelerated Cost Recovery System Macrs A Guide

2

What Is Macrs Definition Asset Life Percentage Exceldatapro

Guide To The Macrs Depreciation Method Chamber Of Commerce

Alternative Depreciation System Ads Overview How It Works Uses

How To Calculate Macrs Depreciation When Why